When operating with customer experience programs, Customer Lifetime Value (CLV) is one of the essential metrics to deal with and keep track of. But why is it important to measure the lifetime value of a customer? And how can you impact it? In this guide, we’ll dig deeper into Customer Lifetime Value and why it includes much more than just crunching numbers.

What is CLV (Customer Lifetime Value)?

Chances are you have heard about CLV (Customer Lifetime Value) before. But just so that we all are on the same page here, or perhaps you’re uncertain about what it encompasses, we provide you with the following definition:

Customer Lifetime Value is the total expected amount of money that a customer spends on your products/services during the entirety of the customer relationship

So, to put that into context: If you sell a cup of coffee to a customer for $3, and they are expected to stop by your shop once a week for the next five years, their CLV amounts to: $3 x 52 weeks x 5 years = $780

Seams simple enough, right? In reality, the calculation is more challenging, especially when you deal with complex product and service offerings. In reality, many wheels are operating behind the scenes to serve the customer.

You might also begin asking yourself questions like: “Why did they stop visiting the coffee shop?” and “How could we get them to spend more than $3 each time?”. That’s where working with CLV gets really interesting.

What makes CLV distinctive?

When discussing what CLV is, it is also relevant to mention what it isn’t.

Metrics such as Net Promoter Score (NPS) and Customer Satisfaction Score (CSAT), which measure customer loyalty and customer satisfaction, respectively, deal with more intangible concepts. As opposed to the NPS and CSAT, Customer Lifetime Value has a more direct link to revenue.

It is also important to distinguish between CLV and CP (Customer Profitability). CP deals with historical data and calculates the gross profit associated with the customer relationship during a specified period.

CLV is, instead, about forecasting future customer value over the lifespan of their relationship with your business.

And when you add CAC (Customer Acquisition Cost) and CTS (Cost to Serve) into the equation, that’s when you can begin to understand what’s driving them to spend, how long your customers typically stick with your business, and what value they ultimately add to your future net earnings.

Why should you care about the lifetime value of a customer?

Knowing your various customers’ CLV is valuable in several ways. Most importantly, it helps you make data-driven business decisions and build a strong foundation for profitability and growth.

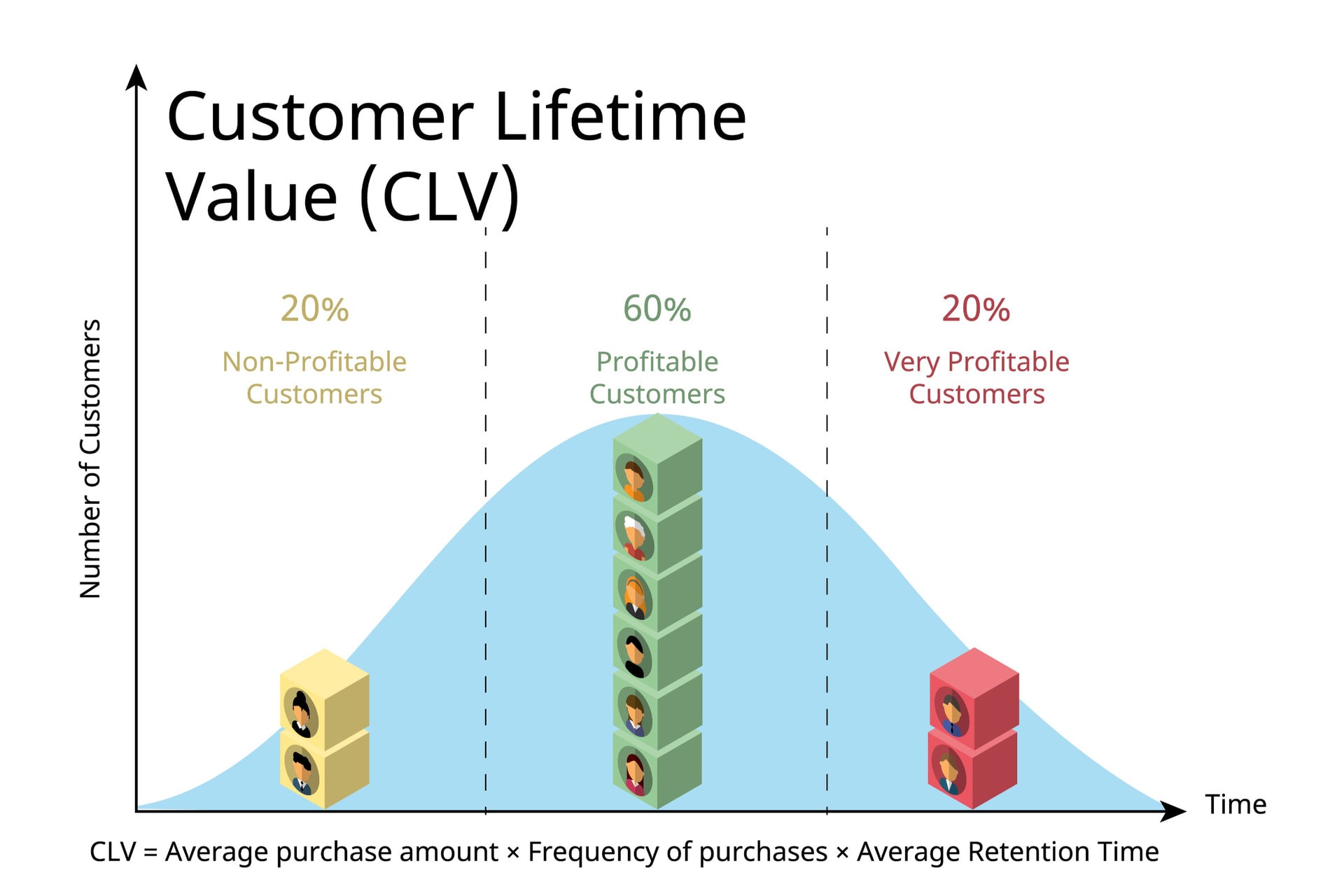

CLV can also provide valuable insights into your different customer segments. Commonly, the customer lifespan can be divided into three categories: non-profitable customers, profitable customers, and very profitable customers.

Your non-profitable customers are your more newly acquired customers and account for approximately 20% of your customer base.

Your profitable customers make up your largest customer group which has done business with you for some time, accounting for about 60% of the total customer base.

The last group, your very profitable customers, typically also account for 20% of the total number of customers, and they are your most loyal customers with the largest average spend.

By knowing who each is and what group they belong to, you can start working with potential improvements and tailor relevant strategies to drive customer value and retention on an individual or segment basis.

5 key advantages of CLV:

- Identify the least and most profitable customer segments

- Measure the profitability of each product or service in your portfolio of offerings

- Detailed tracking of CLV can help improve customer retention and revenue

- Identify the maximum Customer Acquisition Cost allowed

- Tailor and track marketing efforts: campaigns, activities, and initiatives

How to calculate Customer Lifetime Value

The first important note to remember when calculating CLV is that there are multiple ways to do it, and which one is most relevant to you depends on your type of business.

Some calculations are only concerned with total revenue per customer, while more advanced equations take other factors into account as well, such as gross margin and relevant operational expenses. Only in rare cases can it be appropriate to include marketing expenses as it can vary a lot and is, therefore, difficult to make accurate calculations from.

You can base your calculations on either averages or individual or segmented data.

Here are a couple of ways you can calculate CLV:

Common CLV formula

CLV = Average transaction size * Average transaction frequency * Average retention

Average transaction size: Total revenue/number of transactions

Average transaction frequency: Number of transactions/number of customers

Average retention: Sums of customer lifespans/number of customers

You can also include gross margin in the formula to get a more accurate CLV.

How to calculate gross margin:

GM = [(total revenue – COGS) / total revenue] * 100

The predictive calculation of CLV

By using predictive calculation, you can measure the expected lifetime value of a customer. Both historical data and current customer trends are used to help you identify current customer value and forecast changes in the future.

Predictive CLV = (T * AOV * AGM * ALT)/number of customers in n-period

T: Average number of transactions per month

AOV: Average Order Value

AGM: Average Gross Margin

ALT: Average customer lifetime (in months)

The traditional calculation of CLV

Growth is far from always linear. As such, you need to account for changes across the customer lifespan by implementing inflation, gross margins, and retention rate in the equation to get a more nuanced picture of CLV throughout the years. That’s where the traditional calculation of CLV comes in handy:

CLV = GML * [Retention rate / (1+ Rate of discount – Retention rate)]

GML: Gross Margin per customer lifespan

Retention rate: The percentage of customers who stay with you during the measurement period (1/churn rate).

Discount rate: A percentage to account for inflation. Typically, this is set to 10%.

How can you enhance CLV?

Now to ask yourself the million dollar question: “How do I improve the lifetime value of a customer?”. CLV calculations can provide valuable insights, but concrete strategic steps have to be taken to improve CLV.

There are a great number of different strategies that you can use to amplify your CLV. Some of the key areas or levers you can use to maximize the lifetime value of your customers are as follows:

1. Identify improvements to customer experience

Customer experience consists of all the touchpoints your customers have with your business, including the website, customer service, in-store experiences, advertising, return services, and so on. If you put effort into excelling in customer experience across all channels, your customers will be more likely to stick with you due to decreased customer effort.

The key here is to closely monitor all customer interactions to identify potential improvements to customer experience. Customer experience software can be extremely helpful in this case.

2. Excel in customer service

Unhappy customers are never those who stick around. And customer service level can have a big impact on their decision to do and continue to do business with you. As such, it is important to look for ways to offer gold standard customer service. Examples could be:

- Offering omnichannel customer support

- Providing more personalized customer service

- Onboarding and training customer service agents

- Optimizing refund and return processes

- Investing in omnichannel customer center software platforms

- Measuring customer satisfaction (CSAT) and loyalty (NPS)

Also, no bad experiences should be left unsolved. Having a closed feedback loop can help save endangered customer relationships and, if done right, make the relationship stronger than before.

You might like: “NPS for customer service is not a religion – but…”

3. Create customer loyalty programs

Customer loyalty programs are a great way to reward your most frequent and loyal customers. Perhaps they get their 10th coffee order for free? Or the more frequent flyers rake up special discounts based on their miles? By having a rewards program, you can incentivize your customers to keep coming back.

4. Build a strong social media presence

Be where your customers are. That’s the golden rule for reaching customers. And today, they are on social media. Building a strong and active presence on social media can be especially beneficial in your branding and customer communication efforts, leading to greater customer engagement and more prompt responses to customer feedback, which will ultimately support customer acquisition and retention.

5. Increase your prices

A simple way to increase Customer Lifetime Value is to increase the price of your products or services. The trick here is to raise your prices incrementally over long periods to make it less likely to put off current or new customers. But be mindful of the pricing competition in the market and your own pricing strategy.

6. Identify upsell/cross-sell opportunities

Selling to existing customers is typically easier than selling to new customers. In order to reengage your existing customers, you can present them with upselling or cross-selling opportunities. A common example could be that you offer them a premium solution as an upgrade to their current solution, as is the case with TV packages, monthly subscription services, and software solutions. Encouraging your customers to buy more expensive products or offer other relevant products – such as an “often bought together with”-feature – can help increase average purchase value and thereby CLV.

Key takeaway

It is clear why CLV matters for your company and why it is important to adapt your business decisions towards optimizing both average customer lifespan and average customer value.

By focusing on attracting and retaining long-term customers, you will turn more people into advocates for your company, which will also impact repeat purchases and purchase size. CLV calculations, together with CAC budgets, will help set goals for growth and improvements and, ultimately, help you build a more profitable and successful business.