Turn on your customer radar

Make customer feedback a natural part of everyday life. Automate your surveys, get an overview of customers’ experiences and take action where it creates value. We make it easy to measure, understand and act on customer feedback. nps.today replaces complicated questionnaires with few, specific questions, at times that are relevant to the recipient.

A platform adapted to your needs

Features

Measure

Use automated triggers across the entire customer journey with data driven surveys. Embed your customer satisfaction surveys or loyalty surveys across all channels and in your external communication.

Understand

Benefit from dashboards to analyze where to make changes and improve customer experiences. Use categorization or AI to identify opportunities for improvement. Combine other data sources for increased insights.

Act

Set up alarms and automate your individual follow-up and recovery actions in your CRM system. Analyze responses and trends in your preferred BI solution and transform customer experiences based on data.

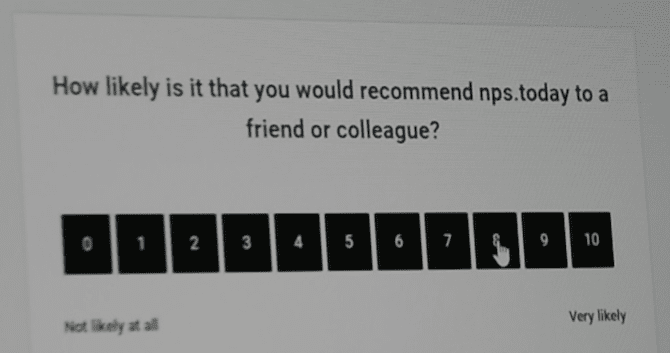

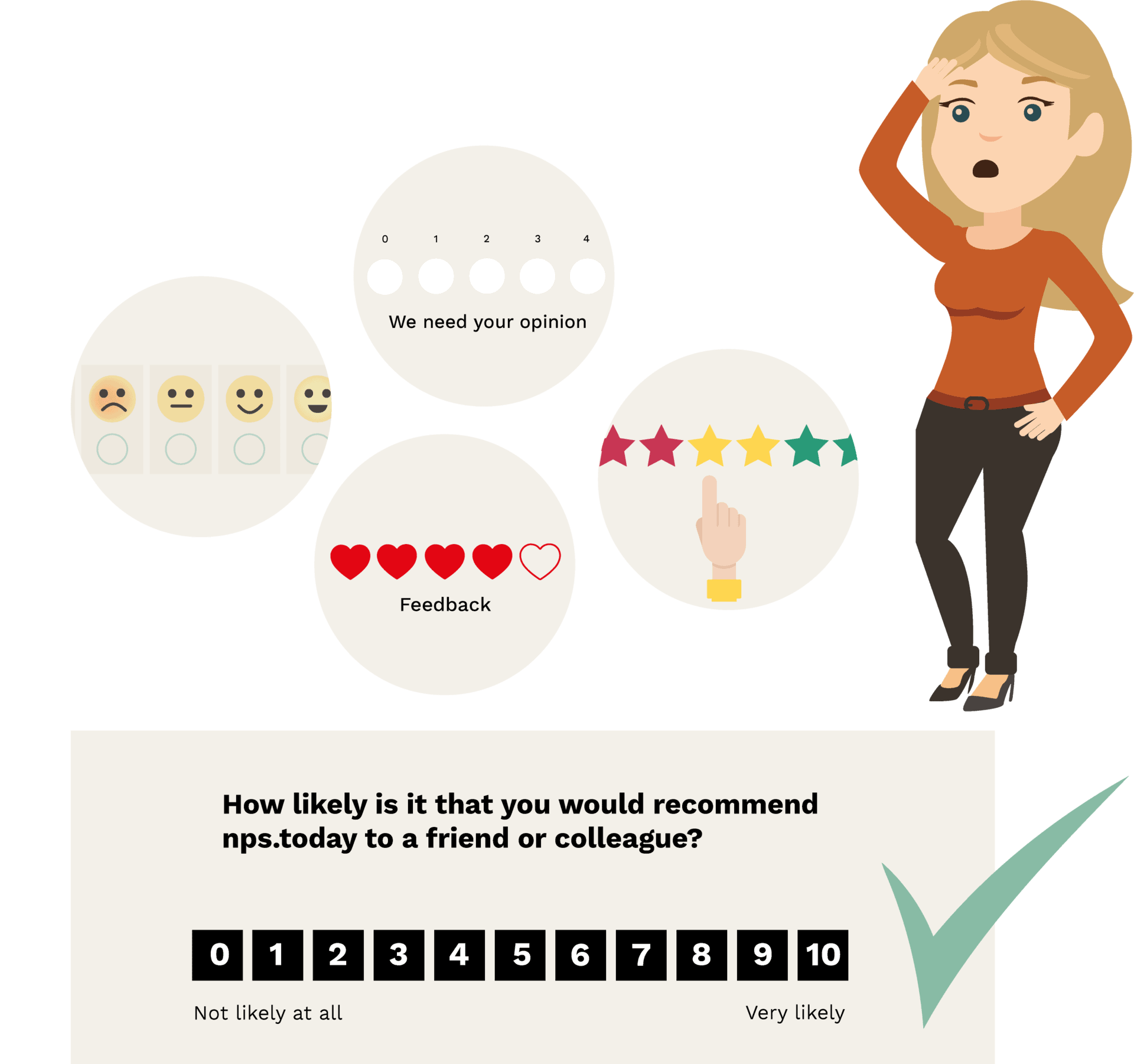

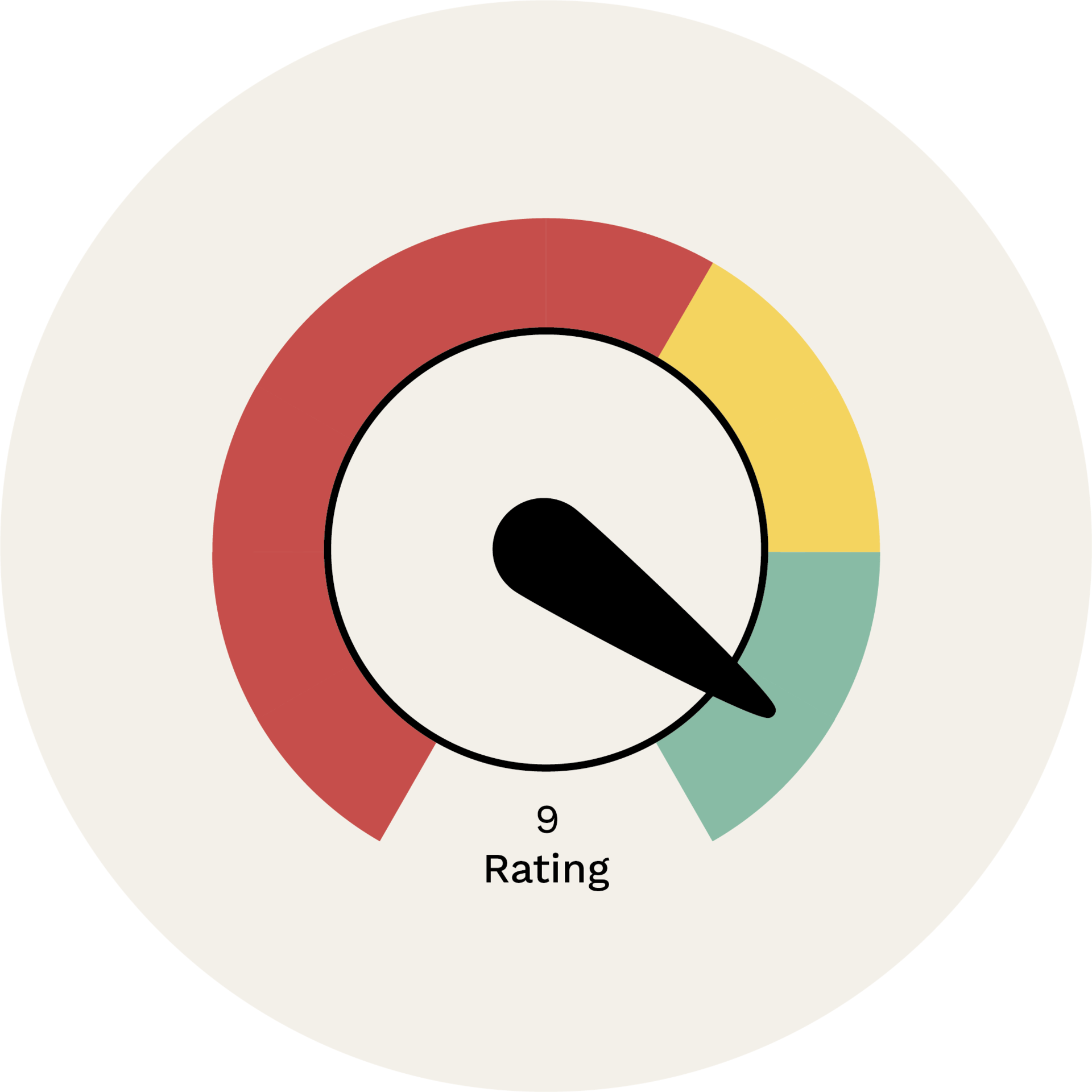

Simplify your CX program with a single scale

Net Promoter Score (NPS®) is the worldwide standard for measuring customer loyalty, using the 0-10 rating scale. With just a single follow-up question, customers share their top-of-mind feedback. This simple and effective method measures both customer loyalty, customer satisfaction and customer effort across the entire customer journey.

Automations across all platforms and systems

Automate your customer experience program across all your IT systems, touchpoints and communication channels. Whether you want to generate your surveys from Zendesk or Salesforce, send them by e-mail or text message, or even embed them in your online communication, we will make sure everything is connected.

Avoid large IT projects with our plug-in solutions

We offer plug-and-play solutions for all the leading customer engagement systems. Whether you work with Microsoft Dynamics, Salesforce or Zendesk, we ensure visible NPS data on both contact and account level. All you need is to install our software, configure and go live with your automated CX program with only minimal IT involvement.

NPS for customer service and contact centers

Providing the right customer service requires that the individual agents in contact centers and customer service, actually understand the customers and are trained to meet their needs.

With nps.today, you get an operational tool to measure, understand and act on your customer experiences, directly from your existing phone and IT systems.

Ignite your customer loyalty today

We are nps.today because we can get you up and running with your automated CX program immediately. We help you implement your solution, so you can get started listening to your customers to improving their experiences and loyalty. All our subscriptions include your own designated NPS and CX Coach. Get your CX program started to measure, understand and act on the feedback of your customers – today.

“It is a fantastic tool for entering into a dialogue with the customer. The large number of responses has ensured that the statistical uncertainty has been removed from the measurements, so that it is not just a single employee who has all the sour customers, but that there is enough data to show a true picture.”

“We quickly realized that nps.today is a really good tool. It was easy to set up and it supports our way of working with loyalty. We get the results immediately and can use it in all our markets.”

“We are in the process of defining the entire customer journey and getting NPS surveys across all the touchpoints, where we want a greater understanding of our customers’ experiences, needs and wishes. In this way, NPS becomes an integral part of the customer journey.”

“It is a tool that works and creates value and is not just a ‘manifested management tool’ that dies after two and a half months. It is an integral part of the organization, it actually gets used and we can report to our board. It gives value in everyday life that we can see what we do well and follow up on the individual member. That is where the true value lies.”

“The advantage is that with nps.today’s solution you get a quick overview of your data using the dashboards we have set up. That means we can act before it’s too late. We can, because we can constantly follow all incoming answers, and continuously see what NPS score our members give us.”